According to Smithers Pira's latest report, The Future of Retail-Ready Packaging to 2024, demand growth for retail ready packaging stems from emerging and transitional economies, with Asia Pacific accounting for 4.5 million tonnes, almost half of total global demand.

Meanwhile, the relatively mature Western markets will grow at a slower-than-average rate through 2024, although South and Central America will have the second highest demand at 1.7 million tonnes. Total global demand is 9.1 million tonnes.

Global retail-ready packaging (RRP) demand exceeded 29.1 million tonnes in 2018, with an average annual growth of 4% since 2014. In 2018, the market was valued at approximately $57.46 billion.

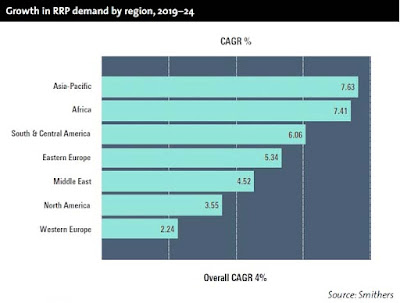

As shown in the figure below, from 2019 to 2024, the consumption of retail ready packaging is expected to grow at an average annual rate of 5.4%, and at constant prices in 2018, the total will reach nearly 40 million tons, worth US$77 billion.

A range of demographic, social and technological drivers will stimulate the demand for retail packaging, from simple population growth to the increased use of flexible packaging, thus requiring global retail packaging displays and sales packaging.As with many packaging consumption, there is a correlation between demographic factors in retail packaging and future demand. In particular, the acceleration of urbanization in the Asia-Pacific region has brought more consumers into contact with Western-style supermarket retailing for the first time, so there is a retail display model.

In the 21st century store, the advantages of a retail or shelf-ready model are essentially the same for retailers and brand owners, but new steps and technologies will help to further cement these advantages for some time to come.

The retailers' advantages

The retailer's advantage lies in reducing in-store costs, such as manually placing shelves or designing specific promotional displays. Large retailers are issuing in-store guidelines for employees on store layouts and standardised shelving. For example, Walmart has a 284-page employee guide that clearly explains how to standardize work.

At the same time, changes in demographics and differences in the types of goods consumers buy are also beneficial for retail packaging. More single-person households and more frequent shopping have shifted the market toward smaller-packaged goods, so more and more pouches are appearing in retail stores.

End-Use Trends

Retail packaging used in the fresh produce, dairy and baked goods markets accounted for more than half of total consumption in 2018. These 3 industries are expected to maintain their dominant market positions for a period of time. Overall, the market share of non-food products is expected to change slightly through 2024.

Innovation is at the forefront of development in the retail packaging industry, with many end-use sectors benefiting from new retail packaging designs.

Pack Formats

In 2018, die-cut containers accounted for 55% of total retail packaging demand, with plastic packaging accounting for nearly 25%. The two packaging formats will continue to maintain their relative positions through 2024.

According to the report, die-cut containers will continue to be popular with slightly above-average market growth, continuing to solidify its current position as the largest market share.

No comments:

Post a Comment